We want to make it as easy as possible for you to enroll in our Medicare Advantage Plans or to answer your questions about coverage and benefits.

To enroll in any of the Nascentia Health Plus insurance plans, the first step is to talk to one of our plan representatives to establish which benefits you qualify for and which plan is a perfect fit for you.

Plan Information

2026 Nascentia Dual Advantage (D-SNP)

2025 Nascentia Dual Advantage (D-SNP)

2026 Nascentia Skilled Nursing Facility (I-SNP)

2025 Nascentia Skilled Nursing Facility (I-SNP)

Find a Doctor

Find a Pharmacy

Prescription Drug Information

Drug Formulary

Member Documents

Our Plans and Enrollment Process

About Medicare and Medicare Advantage

We’re happy to talk to you about our Medicare Advantage Plans and answer any questions about coverage and benefits.

Nascentia Dual Advantage (D-SNP) is a Medicare Advantage Special Needs Plan for those who are dually eligible for Medicare and Medicaid that combines Medicare Parts A, B and D, with additional benefits.

To join our Nascentia Health Dual Advantage (D-SNP) Plan (HMO SNP) you:

- Must be enrolled in Medicare Part A and Part B

- Must be enrolled for full Medicaid benefits and/or assistance with Medicare premiums or cost sharing

- Must continue to pay your Medicare Part B premium if it’s not paid for by Medicaid or another third party

- Must live in the Nascentia Health Plus service area

- Must not have End-Stage Renal Disease (ESRD), with limited exceptions

View Nascentia Dual Advantage (D-SNP) Plan Details

Nascentia Skilled Nursing Facility (I-SNP) is a Medicare Advantage Special Needs Plan designed to provide coordinated and enhanced care to nursing home residents.

To join our Nascentia Health Skilled Nursing (I-SNP) Plan (HMO SNP) you:

- Must be enrolled in Medicare Part A and Part B

- Must, for 90 days or longer, require or are expected to need the level of services provided in a long-term care (LTC) skilled nursing facility (SNF)

- Must continue to pay your Medicare Part B premium if it’s not paid for by Medicaid or another third party

- Must be a resident of one of our participating nursing home partners:

- Loretto Health & Rehabilitation

- Must not have End-Stage Renal Disease (ESRD), with limited exceptions

View Nascentia Skilled Nursing Facility (I-SNP) Plan Details

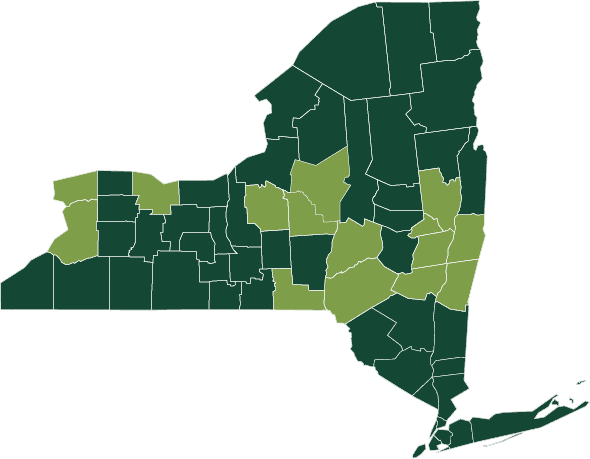

Our Service Area includes Albany, Broome, Columbia, Delaware, Erie, Greene, Madison, Monroe, Niagara, Oneida, Onondaga, Otsego, Rensselaer, Saratoga, and Schenectady counties.

Medicare Enrollment Periods

Enrolling in Original Medicare (Parts A and B) for the first time

If you’re eligible for Medicare, you may be automatically enrolled in Original Medicare (Parts A and B) through the federal government if you already get Social Security benefits or become eligible for Medicare due to disability. You’ll need to enroll yourself in Medicare during your Initial Enrollment Period if you’re turning 65 and will not be automatically enrolled. You might also be able to enroll in Medicare at another time during the year if you qualify for Medicare due to a disability or other special circumstance. Learn more about how to enroll at https://www.ssa.gov/benefits/medicare/, or by calling or visiting your local Social Security office.

Initial Enrollment Period (IEP)

It’s best to enroll in Medicare during your IEP, a 7-month long window. It includes your birthday month plus the 3 months before and the 3 months after. Enrolling in Medicare during this time helps you avoid the Part B late enrollment penalty. If you become eligible for Medicare due to disability, your 7-month IEP includes the month you receive your 25th disability check plus the 3 months before and the 3 months after.

After you enroll in Medicare Parts A and/or B, you may choose to apply for additional coverage. If you enroll in both Part A and Part B, you may choose to apply for a Medicare Advantage (Part C), Medicare Prescription Drug (Part D), or Medicare Supplement insurance plan. You can also apply for a Part D plan if you only enroll in Medicare Part B during your IEP.

Annual Open Enrollment Period (OEP): October 15 – December 7

Join, switch or drop a plan during the Annual Enrollment Period (AEP). Open Enrollment Period (OEP). If you don’t make any changes during AEP, your current plan will automatically renew the following year.

Eligible individuals may enroll in or change Medicare Advantage plans. Coverage will be effective January 1. You will receive acknowledgement letters from Nascentia Health Plus when your application is processed, along with a confirmation letter and ID cards when your application is approved by the federal government. You may enroll in only one Medicare Advantage plan at a time, and you may join or leave that plan at certain times of the year or in special circumstances.

General Enrollment Period (GEP): January 1 – March 31

This period is specifically for beneficiaries who did not sign up for Medicare Part B at the right time. Be aware that your coverage will not begin until July 1, and you may be required to pay a late penalty based on how many years you have delayed.

Special Enrollment Period (SEP)

If you would like to enroll in a Nascentia Health Plus Medicare Advantage plan outside the annual election period, you may qualify for a Special Enrollment Period.

Certain life changes let you enroll outside the Initial Enrollment Period. If you continue to work past 65 and lose employer coverage, you are eligible for a Special Enrollment Period. Life changes include: Retiring and no longer having coverage from an employer, moving into a nursing facility, or moving out of your current plan’s service area.

Enroll in Original Medicare (Parts A & B) first. If you are 65 and eligible for Medicare, you have 8 months to enroll in Original Medicare without a late penalty after the month your employment or employer coverage ends, whichever comes first. This is also true if you are covered under your spouse’s employer coverage.

You need to act quickly if you want additional coverage. Your 8-month SEP includes a 2-month window to enroll in Part C or Part D. You have 2 months after the month your employment or employer coverage ends to enroll in a Medicare Advantage (Part C) or Medicare Prescription Drug (Part D) plan. And remember: you need Part A or Part B (or both) to enroll in a Medicare Advantage or Medicare Prescription Drug plan.

Individuals with both Medicare and Medicaid can enroll throughout the year and can change plans once per quarter if they are unsatisfied with their current benefits.

Annual Disenrollment Period: January 1 – February 14

If you are enrolled in a Medicare Advantage health plan but want to change to Original Medicare coverage, you may do so during this time. You may also sign up for a Part D prescription drug plan at this time. You may NOT use this time to switch from one Medicare Advantage plan to another.

Medicare Advantage Disenrollment (Leaving the Plan) Rights & Responsibilities

“Disenrollment” means ending your membership in Nascentia Health’s Medicare Advantage plans. You can choose to return to Original Medicare and will need to select a separate Medicare prescription drug plan. Your new plan coverage will begin on the first day of the month after we receive your request.

You may not enroll in a new plan during other times of the year unless you meet certain exceptions, such as moving out of the plan’s service area, joining a plan in your area with a 5-star rating, or qualifying for extra help with your prescription drug costs.

Upon disenrollment, you will receive a letter confirming your request, information about Medigap rights (if returning to Original Medicare), and the date your plan coverage will end. You must continue to receive all medical care from Nascentia Health Plus participating providers until the date noted. We will notify you if Medicare denies your disenrollment request.

If your new plan does not include creditable prescription drug coverage (coverage that is at least as good as Medicare’s), you may pay a penalty if you join a Medicare drug plan later.

Nascentia Health Plus must end your membership in our plan in certain situations:

- If you do not stay continuously enrolled in Medicare Part A and Part B

- If you move out of our service area

- If you are more than 90 days behind in your premium payment

- If you are required to pay the extra Part D amount to Medicare because of your income and you do not pay it

Please refer to your Evidence of Coverage for more information. If we end your membership, we will send you our reasons in writing. We cannot ask you to leave our plan for any health-related reason.

Medicare Enrollment Guide

How and When to Enroll in Medicare

If you have any questions, please contact Member Services: 1-888-477-4663 (TTY: 711).

Hours of Operation: 8am-8pm, Mon-Fri (April-Sept), 8am-8pm, 7 days a week (Oct-March)

Last Updated on October 1, 2025